Achieve IRS Compliance for 1099 Contractors in 4 Simple Steps

Onboard Vendors

Collect W-9s Securely

Record Vendor Activities & Payouts

E-file & Distribute 1099

A Closer Look at How Express1099 Works

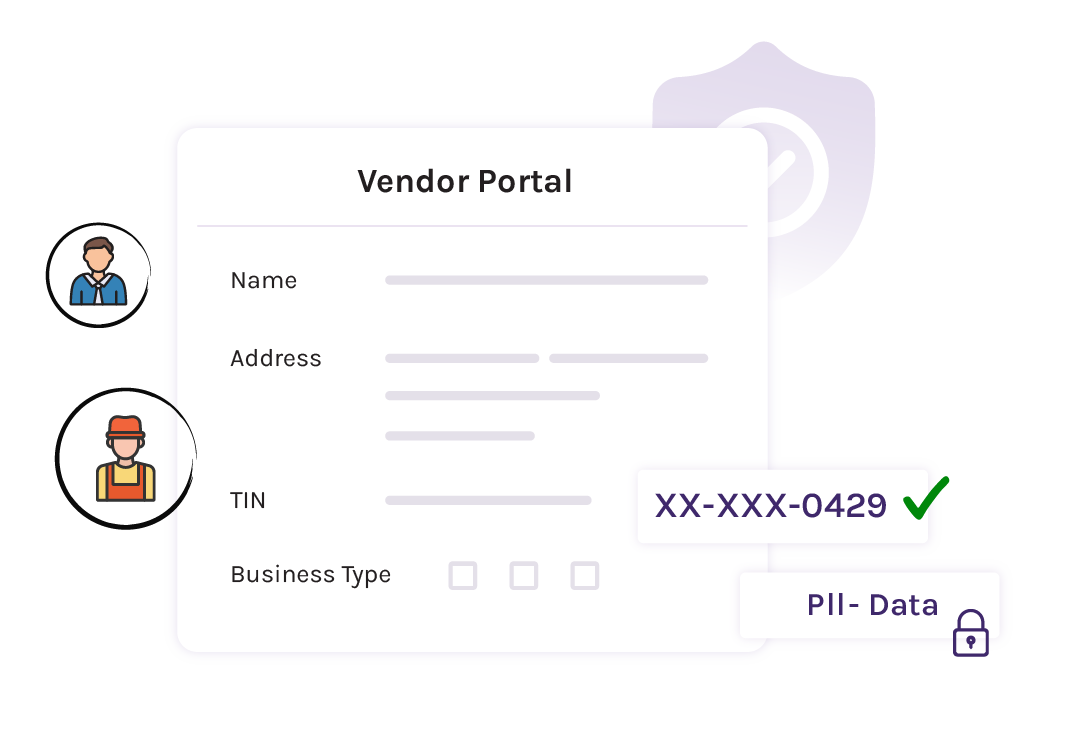

Onboard Vendors & Securely Collect their W-9s!

- Enable self or assisted vendor onboarding from your customized vendor portal. Collect account information, bank details, and W-9 data securely.

- We perform TIN Matching on the W-9s, ensuring each vendor’s TIN matches the IRS database. This can help you avoid receiving B-Notices from the IRS.

- Our system securely stores the PII data in the W-9s you collect, and this information is used when generating year-end 1099 filings.

Record Activities and Payouts Accurately!

- Accurately record and track your vendor activities, such as rides, deliveries, gigs, etc., and the payouts made to them throughout the year.

- Express1099 offers 3 options for recording this data

- Manual entry

- Bulk Upload using Excel templates

- API integration

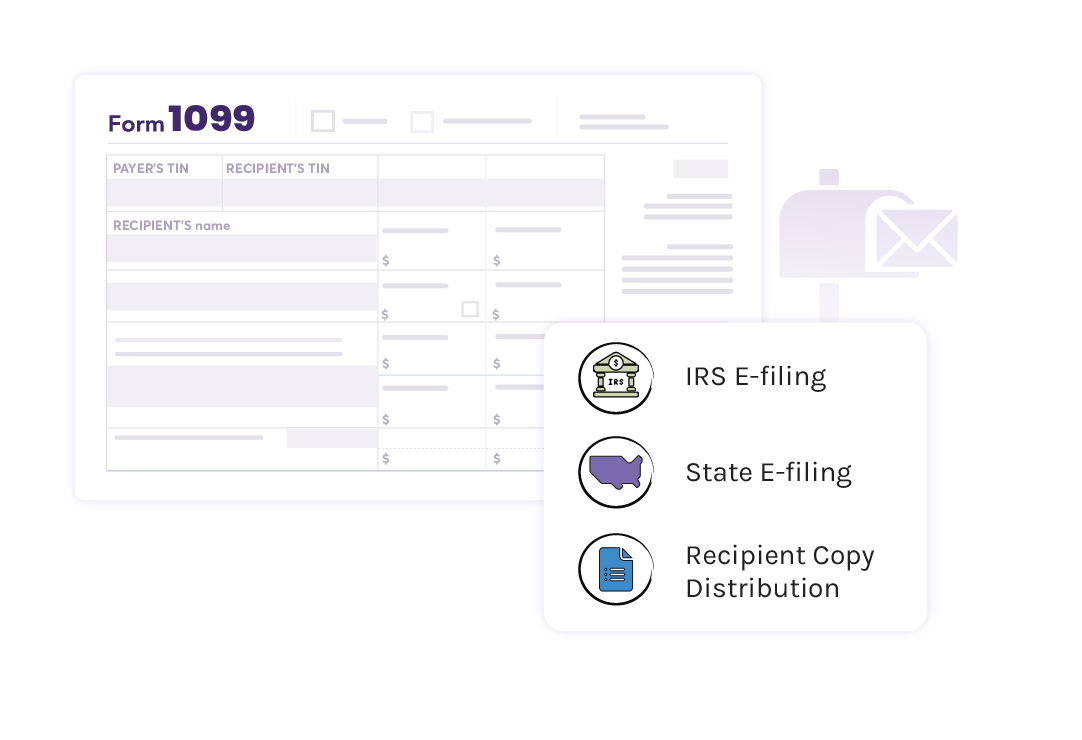

Automate 1099 E-filing & Distribution!

- Express1099 validates and generates the applicable 1099 forms at the year-end based on the IRS tax classification using the W-9 and payout information.

- Once you have reviewed and approved the generated forms, our system will e-file the 1099s with the IRS and required states.

- Your vendors can download their 1099 copies from their portal. You can also opt for postal mailing to distribute the physical copies of 1099s to your vendors.

Our Exclusive Features for Efficient 1099 Vendor Management!

- Your Own Vendor Portal

Use our customized vendor portal to onboard your vendors and let them complete their W-9s, track activity & payouts, and access 1099 copies as needed. - Customizations

Customize the Vendor Portal with a unique URL, logo, and theme to reflect your company’s branding.

- Vendor Data Import

Add your vendors manually or upload in bulk using our Excel templates. If you have their historic W-9 copies, you can upload them as well. - Activities & Payout Data Import

Record payouts and activities manually, via bulk upload, or by seamlessly integrating with the API.

- TIN Matching

Express1099 performs TIN Matching to ensure that the TINs provided on W-9 match the IRS database. This ensures accurate 1099 filing. - Business & Address Validations

In addition to TIN Matching, we perform business validation, USPS address validation, and other basic validations to ensure the accuracy of the 1099 returns.

- SOC-2 Certified

We are a SOC 2 Certified company, and our team incorporates advanced security protocols into the system to safeguard your data. - PII Data Security

Express1099 securely stores and processes all Personally Identifiable Information (PII), such as TINs.

- Your Own Vendor Portal

Use our customized vendor portal to onboard your vendors and let them complete their W-9s, track activity & payouts, and access 1099 copies as needed. - Customizations

Customize the Vendor Portal with a unique URL, logo, and theme to reflect your company’s branding.

- Vendor Data Import

Add your vendors manually or upload in bulk using our Excel templates. If you have their historic W-9 copies, you can upload them as well. - Activities & Payout Data Import

Record payouts and activities manually, via bulk upload, or by seamlessly integrating with the API.

- TIN Matching

Express1099 performs TIN Matching to ensure that the TINs provided on W-9 match the IRS database. This ensures accurate 1099 filing. - Business & Address Validations

In addition to TIN Matching, we perform business validation, USPS address validation, and other basic validations to ensure the accuracy of the 1099 returns.

- SOC-2 Certified

We are a SOC 2 Certified company, and our team incorporates advanced security protocols into the system to safeguard your data. - PII Data Security

Express1099 securely stores and processes all Personally Identifiable Information (PII), such as TINs.